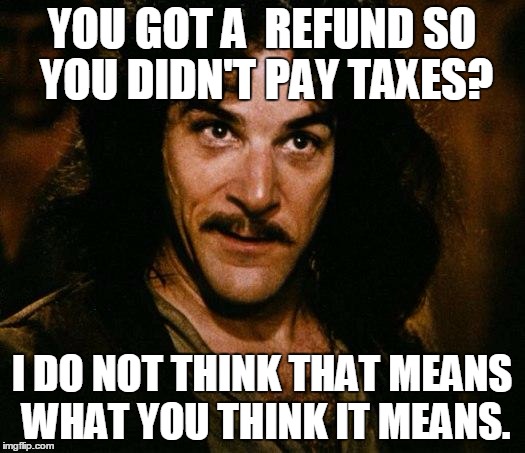

While companies have seen annual cost-savings from utilizing remote-workers, they could also face a surprise depending on the tax situations.

When hiring your remote employees, you may need to consider and research certain options, in tandem with your HR and payroll offices: Potential Surprise Tax MattersĪs more companies continue to increase their telework options, especially when hiring fully remote employees, there will be a few business tax matters you’ll want to research before diving into the hiring process for remote workers. A Stanford study even shows that offering telecommute work options to employees halves the attrition rate and that home-working led to a 13-percent performance increase with increased employee satisfaction. The working-from-home population has been on the rise and has grown by 159% since 2005, according to Global Work Place Analytics.

Many known benefits exist for both a company and the employee and it’s a trend that will likely continue as the technology exists to allow for remote work arrangements, whether close-to-home, out of state or even abroad. Hiring remote employees has become more common and even popular among job-seekers and companies alike.

0 kommentar(er)

0 kommentar(er)